stock market kya hai, mujhe lagta hai aapko ise samjhne me jayda der nahi lagega. ???? Aaj ka humara safar hai stock market ke fascinating duniya mein, jahan har kona ek naya gyaan lekar aata hai. Toh chaliye, shuru karte hain!

Stock Market Kya Hai

sab se pahle isko samjh le ki Stock Market Kya Hai Aur Share Market Kya Hai dono ek hi chij ke 2 naam hain. to samjhte hain stock market ko.

Stock market, ek aisi jagah hai jahan companies apne shares ko bechti hain aur investors un shares ko khareedte hain. Lekin isme koi choti-badi baat nahi hoti; yahan har stock ek kahani hai, har investment ek risk hai, aur har profit ek celebration????!

Stock Market Kaise Kaam Karta Hai?????

stock market kya hai aur ke kaam karne ka tarika to bhut jatil hain, lekin samjhna aasan hain yah to apne dekhna hoga ki Stock market ek dynamic aur volatile jagah hai jaha par stocks ke prices har second badalte rehte hai. kabhi Red ????To Kabhi Green???? Hote rahte Hain.

itna to apko pata hoga ki Iska basic concept yeh hai ki jab ek company apne shares ko public issue karti hai, tab investors us company ke shares ko khareed sakte hai. Jab investors shares khareedte hai, toh woh company ke owners ban jaate hai. Unhe ownership rights milte hain aur woh company ke profit ya loss ka hissa ban jaate hain.

stocks ke upar ya niche hone ke bhut se kaard hote hain, aur isi trah yah stock market kaam karta hain, kabhi upar to kabhi niche company ne achha profit dikhaye to uska share badh ???? jata hai, agar profit kam hua to share price niche girne ???? lagta hain.

mujhe umid hai aapko itna to samjh aa gaya hoga ab hum jante hain trading ke bare me.

Stock Market Mein Trading Kaise Hoti Hai?????

Trading stock exchanges par hoti hai jaise ki Bombay Stock Exchange (BSE) aur National Stock Exchange (NSE) India mein. Yaha par buyers aur sellers milte hain aur unke beech stock transactions hote hain.

Stock market mein equity instruments trade hoti hain, jaise ki common stocks, preferred stocks, bonds, mutual funds etc. Share prices demand aur supply ke basis par badalte rehte hain. Agar demand zyada hoti hai toh share prices increase ???? ho jaate hain aur agar supply zyada hoti hai toh share prices decrease???? ho jaate hain.

Stock market me Upar Niche (volatility) ka reason various factors se juda hota hai jaise ki economic conditions, political events, company performance etc. Investors apne research and analysis se stocks ko select karte hain taki unhe acche returns mile.

Demat Account Kya Hota Hai?

Yah bank ki trah ek account hota hai, jisme paise ki jagh par aapke shares rakhe jate hain,

Demat account ka full form “Dematerialized Account” hota hai, aur yeh ek electronic form ka account hota hai jahan par aap apne financial instruments ko electronically hold karte hain.

Yeh account stocks, bonds, mutual funds, government securities, aur other financial instruments ko store karne mein help karta hai.

Yeh account share market mein trading karne ke liye zaroori hota hai, kyun ki physical certificates ki jagah electronic form mein securities ko hold karta hai. Jab aap kisi share ya financial instrument ko kharidte hain, toh woh aapke demat account mein electronically store ho jata hai.

Ismein har ek financial instrument ko ek unique number ya identifier diya jata hai, jise DP ID (Depository Participant Identification) kehte hain.

Demat account ke bina aap share market mein trading nahi kar sakte, kyunki stock exchanges mein transactions electronic form mein hi hoti hain. Isliye, agar aap stocks mein invest karna chahte hain ya trading karna chahte hain, toh aapko ek demat account open karna hoga.

Demat Account Kaise Khole ????

aaj ke time me demat account online open karna bhut aasan ho gaya hain, hum apne smart phone se aasani se kisi bhi achhe stock brokers se khol sakte hain,

Demat account khulwane ke liye aapko kuch simple steps follow karne honge. Yahan maine aapko step-by-step guide di hai:

1. Account Ka Prakar Decide Karein:

- Decide karein ki aap kis prakar ke account khulwana chahte hain, kya aap individual account, joint account, or a corporate account.

2. Depository Participant (DP) Chunein:

- DP ek aisa vyakti ya sanstha hoti hai jo aapke demat account ko sambhalta hai. Vibhinn vittiy sansthaayein, bank, aur stockbrokers DP ke roop mein kaam karti hain. Apne avashyaktaanusaar ek DP chunein.

3. Documents

- aapke pass yah sab Documents hone chaiye Avashyak dastavez, jaise:

- Identity proof (PAN card, Aadhar card, passport, voter ID, etc.)

- Address proof (utility bills, passport, Aadhar card, etc.)

- Passport size photographs

- Bank statements or canceled cheque for linking your bank account

4. Account Khulwane

- aap kisi bhi stock brokers ke pass online account opne karva sakte hain, kuch achhe stock broker ke naam Zerodha, Upstox, Angel Broking, Sharekhan, Groww. aur bhi bhut se hain.

5. Trading Shuru Karein

Jab aapka demat account sakriya ho jata hai, to aap stock market mein trading shuru kar sakte hain. Aap apne demat account ke madhyam se share, mutual funds, aur anya surakshaon ko khareed sakte hain aur bech sakte hain.

Stock Market Books in Hindi

Stock market Kya Hai sikhne ke liye kuch achhi kitaabein hain jo aapko mool siddhant, vyavsayik tareeqon, aur invest karne ke tariqon ko samajhne mein madad karti hain. Yahan kuch prasiddh stock market books hain:

- “The Intelligent Investor” by Benjamin Graham:

- Yeh kitaab ek classic hai aur value investing ke mool siddhanton ko samajhne mein madad karti hai. Benjamin Graham ko “value investing” ke pitaji maana jaata hai.

- “A Random Walk Down Wall Street” by Burton Malkiel:

- Yeh kitaab stock market investment ke various aspects ko cover karti hai aur market trends ko samajhne mein madad karti hai.

- “Common Stocks and Uncommon Profits” by Philip Fisher:

- Philip Fisher ke dwara likhi gayi yeh kitaab un common stocks ke tareeqon par dhyan deti hai jo long-term investment ke liye suitable ho sakte hain.

- “One Up On Wall Street” by Peter Lynch:

- Is kitaab mein Peter Lynch apne successful career ke anubhavon ko bantte hain aur investors ko sahayak sujhav dete hain.

- “How to Make Money in Stocks” by William J. O’Neil:

- Yeh kitaab un strategies par dhyan deti hai jo stocks ko analyze karne aur unmein invest karne ke liye upyukt ho sakti hain.

- “Rich Dad Poor Dad” by Robert Kiyosaki:

- Yeh kitaab mool siddhanton ko samajhne mein madad karti hai aur wealth banane ke various tareeqon par dhyan deti hai.

- “Security Analysis” by Benjamin Graham and David Dodd:

- Yeh ek aur kitaab hai jo Benjamin Graham ki sahayakata mein likhi gayi hai aur fundamental analysis par kendrit hai.

- “The Little Book That Still Beats the Market” by Joel Greenblatt:

- Joel Greenblatt ke dwara likhi gayi yeh kitaab value investing par adharit hai aur investors ko stock selection mein madad karti hai.

- “The Warren Buffett Way” by Robert G. Hagstrom:

- Is kitaab mein Warren Buffett ke vyavsayik tareeqon, sochne ke tareeqon, aur investments ke siddhanton ko explore kiya gaya hai.

- “Stocks to Riches” by Parag Parikh:

- Yeh kitaab Indian stock market aur usmein invest karne ke tareeqon par dhyan deti hai.

Yeh kitaabein aapko stock market ke vibhinn pehluon ko samajhne mein aur successful investing ke liye sahayak hongi. Dhyan rahe ki market dynamics badalte rehte hain, isliye regular reading aur market updates par bhi dhyan dena important hai.

Share Market Kya Hai in Hindi PDF

humne aapke padhne ke liye kuch Share Market Kya Hai in Hindi PDF taiyar kiya hain aap samay nikal kar in pdf ko padh sakte hian aur apne gyan ko in Stock Market Kya hai ko badha sakte hain.

FAQ

Share Kya Hota Hai?

Share, ya stock, ek company ka ek chhota hissa hota hai. Jab aap kisi company ke share khareedte hain, toh aap us company ke malik ka ek chhota hissa ban jaate hain.

Stock Exchange Kya Hai?

Stock exchange woh jagah hai jahan stocks aur securities kharidi aur biki jaati hain. India mein, BSE (Bombay Stock Exchange) aur NSE (National Stock Exchange) pramukh stock exchanges hain.

Bull aur Bear Market Mein Kya Antar Hai?

Bull market mein share prices badhte hain, jabki bear market mein prices ghat jaati hain. Bull market mein investors optimistic hote hain aur jyadatar log khareedte hain. Bear market mein, pessimism hota hai aur jyadatar log shares bechte hain.

Index Kya Hai?

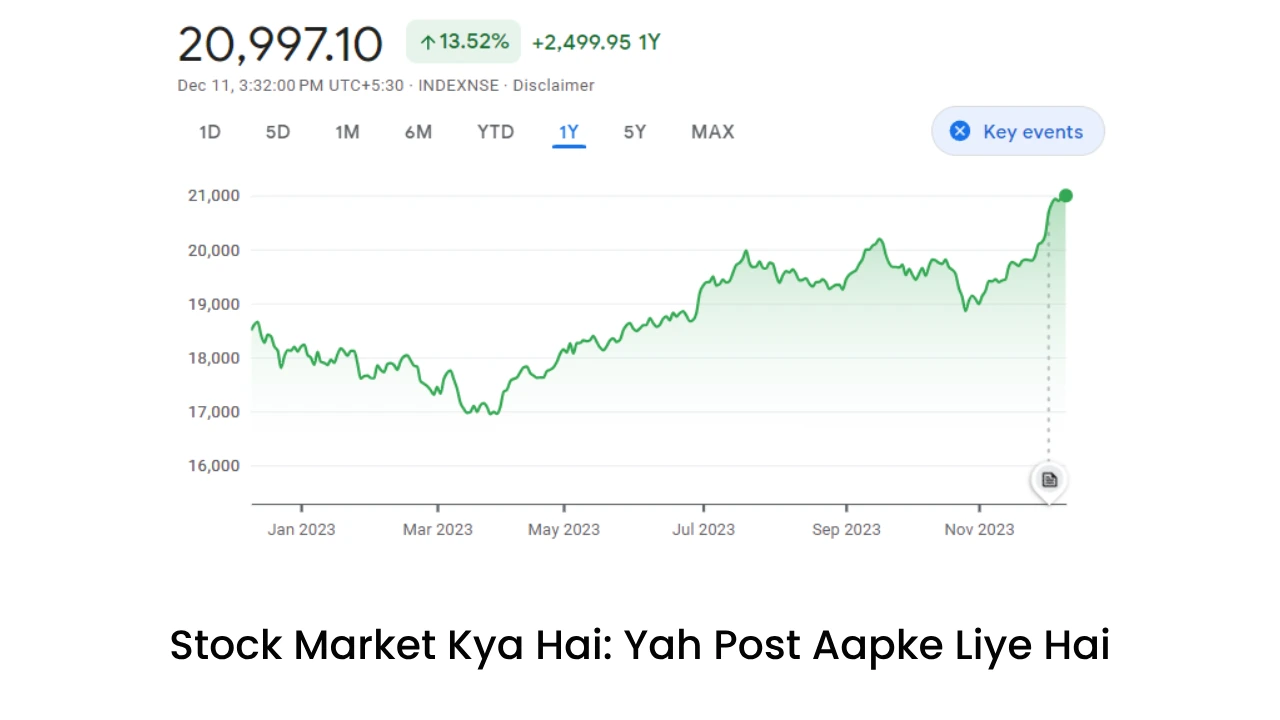

Index ek tarah ka financial indicator hota hai jo stock market ke performance ko darusth karti hai. Examples include Sensex aur Nifty.

IPO Kya Hota Hai?

IPO (Initial Public Offering) ek process hai jisme koi bhi private company public company banne ka faisla karti hai aur apne shares ko public ke liye bechti hai.

Dividend Kya Hota Hai?

Dividend woh paisa hai jo company apne shareholders ko profit ke roop mein deti hai. Yeh shareholders ko regular intervals par milta hai, jaise har quarter ya har saal.

Trading aur Investment Mein Kya Antar Hai?

Trading mein log stocks ko short term ke liye khareedte hain aur jaldi bech dete hain, jabki investment mein log stocks ko long term ke liye rakhte hain aur unka fayda lambi avadhi tak dekhte hain.

Risk Kaise Manage Karein?

Risk management ke liye diversification, research, aur stop-loss orders ka istemal kiya ja sakta hai. Diversification mein aap apne paisa ko alag-alag tariko mein invest karte hain taki agar ek sector mein loss hota hai toh doosre sectors ka asar kam ho.

Nishkarsh

Mujhe umid hain aapko stock market Kya Hai ke bare me basic jaanakri ho gai hai, yah post aapko kaisa laga niche comment jarur kare. Stock market me invest karna ek strategic decision hoti hai aur investors ko market trends, company performance, aur economic factors ka dhyan rakhna chahiye. Risk management aur research ke bina stock market me safalta prapt karna mushkil ho sakta hai.

Delhi

Please resolve this.

Hi